Cashback has been around for some time but when Singaporeans (including myself) see the word cashback every now and then, our hearts skip a beat. You mean I can get some money back? *googly heart eyes*

With Covid, we’ve tasted and seen how we can actually get a lot of things online. I personally found myself buying a lot of things online because let’s face it – things are just so easily available online.

What if you knew that you could get cashback through your online purchases and this includes things like your Netflix or Spotify subscription?

OCBC Frank Credit Card

Honestly, when I heard of the OCBC Frank Credit Card, the first thing that came to my mind was “Isn’t that for students?”. But it turns out that the one marketed for students was the FRANK Debit Card (Oops).

Well, the OCBC Frank Credit Card isn’t really targeted for students (min Annual Income of $30k is required). I would say it’s more of a working adult card, and a great deal for those who love online shopping, but more on that later.

6% Cashback

The OCBC Frank Credit Card offers a 6% cashback for all online and in-app purchases as well as a 6% cashback for purchases made in-store using Apple Pay, Samsung Pay, Google Pay, Fitbit Pay or Garmin Pay.

The catch? A minimum spend of $600/month is required. For any spend less than $600 a month, your cashback rate would be 0.3% instead of the usual 6%.

What Is Defined As An Online Purchase?

According to OCBC, online transactions are defined as goods and services you buy via the internet and mobile apps. These include Grab, Lazada/Redmart, Netflix, Spotify, NTUC online and Taobao.

So, for those who constantly shop online, this might just be the card for all your purchases.

How To Get The Most Out Of Your OCBC Frank Credit Card

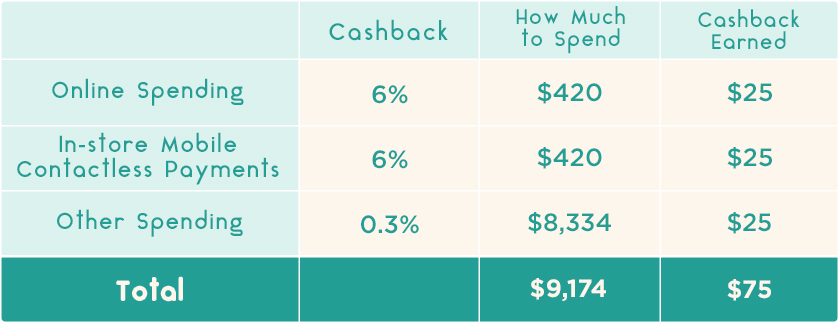

While you can earn up to $75 cashback through the OCBC Frank Credit Card, I’m going to be honest and say it is nearly impossible for a middle-class Singaporean.

Why? Simple: Sub-caps.

For each category, the maximum amount of cashback you can receive is $25.

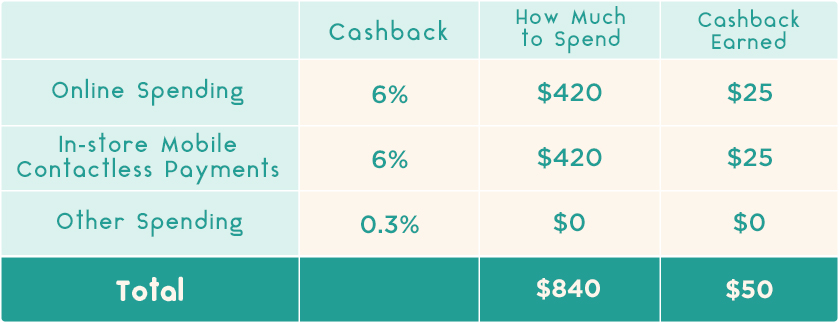

The good news is, it is very easy and highly possible for you to earn your $50 cashback if you’re an avid online shopper and/or loves doing everything online.

Some Examples

Assuming that the OCBC Frank Credit Card is going to be your first credit card, chances are, you’re probably going to hit the minimum monthly spend of $600.

However, if you’re thinking of using the OCBC Frank Credit Card for your online purchases to get some cashback from your spending, here’s how to get the most out of it.

The easiest way to get the most is to spend a minimum of $420 on online spending and $420 using Apple Pay, Samsung Pay, Google Pay, Fitbit Pay or Garmin Pay for in-store payments.

This method would get you $50 in cashback.

Upon getting your card, I would recommend linking the card to your preferred contactless payment method immediately, so you won’t “waste” any purchases.

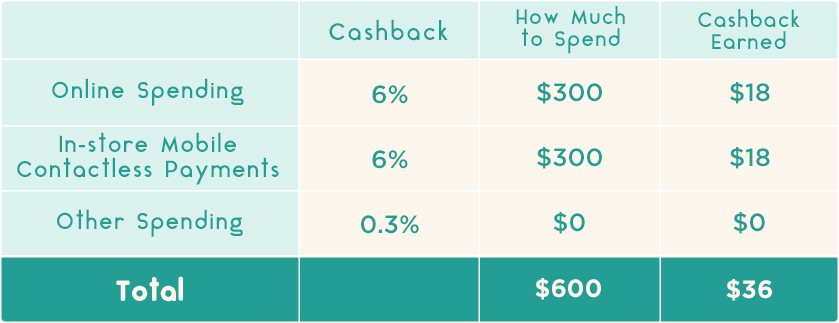

Assuming you only wish to hit the minimum amount required per month of $600, an equal split between online spending and in-store mobile contactless payments would still earn you $36 in cashback. That’s more than a 3-month subscription to Spotify!

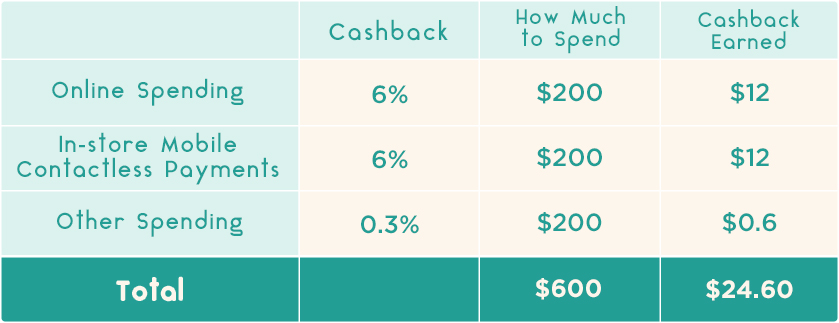

You can really see the difference $100 makes in each category, with the cashback being significantly lower for online spending and in-store mobile contactless payments.

This is why the OCBC Frank Credit Card is highly recommended for those who use digital services frequently. You can even get cashback from your subscriptions to Netflix and Spotify.

Extra $50 Cashback + $50 Grab Vouchers

If you’re signing up as a new OCBC cardmember, you can receive an additional $50 cashback and $50 Grab vouchers. As for existing OCBC cardmembers, you can get $20 cashback when you apply for the card.

Limited to the first 500 customers, respectively. Promotion is valid till the 31st of Dec 2020.

To apply and learn more about the OCBC Frank Credit Card, you can use the link here.

*Follow MiddleClass.sg on Facebook, Instagram and Telegram for more food, travel and trending stories!

*Some links in this article are affiliate links, but all opinions are ours.